BLBD - BLUE BIRD CORP: RACING AHEAD IN THE SCHOOL BUS INDUSTRY

BLUE BIRD CORP: RACING AHEAD IN THE SCHOOL BUS INDUSTRY

15 FEB BLUE BIRD CORP: RACING AHEAD IN THE SCHOOL BUS INDUSTRY

Blue Bird Corporation (NASDAQ: BLBD), a leader in electric and low-emission school buses has been providing alternative power solutions since 1991. As the number one manufacturer of alternative fuel school buses, Blue Bird has produced six times more alternative powered buses than all of its competitors combined.

The Company

Blue Bird has sold more than 592,000 buses since its formation in 1927. The Company reviews and presents their business in two operating/ reportable segments (i) the Bus segment, which involves the design, engineering, manufacture and sale of school buses and extended warranties; and (ii) the Parts segment, which includes the sale of replacement bus parts.

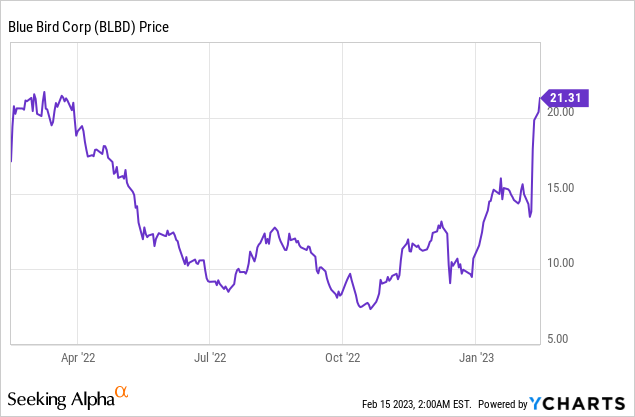

Blue Bird Corporation (NASDAQ: BLBD)

Market Cap: $682.60M; Current Share Price: $21.31

Data by YCharts

Q1 FY23 Performance and Full Year Guidance

The Company recently announced outstanding results for Q1 FY23 where net sales were $235.7 million, an increase of $106.5 million, or 82.4%, from the prior year period. Bus sales increased $100.8 million, reflecting a 11.4% increase in average sales price per unit, resulting from pricing actions taken by management to partially offset increases in inventory purchase costs as well as product and customer mix change, and a 70.3% increase in units booked.

Q1 FY23 gross profit was $7.5 million – a decrease of $8.7 million from Q1 FY22. The decrease was primarily driven by only partial price increases on old backlog units, which were more than offset by increases in manufacturing costs attributable to a) increased raw materials costs resulting from ongoing inflationary pressures and b) ongoing supply chain disruptions that resulted in higher purchase costs for components and freight.

However, the Company seems poised for exceptional growth in the next few quarters as they have worked through the majority of the legacy-priced units in the backlog that caused margin compression over the past several quarters, and also executed a rigorous plan to improve operations, reduce fixed costs, and recover economics through pricing.

Image Source: Company

It is to be noted that at the end of Q1 FY23, Blue Bird’s electric school bus bookings were up 130%.

In addition, the EPA has awarded nearly $1 billion in funding to almost 400 school districts in the first year of the Clean School Bus Rebate Program, and this funding alone is expected to generate additional orders for an estimated 500-700 Blue Bird electric buses translating into a minimum of $200 million of additional revenue.

As a result of the above factors, the Company has raised full year FY23 guidance to Net Revenue of just over $1 Billion, Adj. EBITDA of $40-46 million and Adj. Free Cash Flow of $5-11 million. Blue Bird also confirmed long-term outlook of profitable growth towards $2 billion in revenues and Adjusted EBITDA margins of 12%, or $250 million.

At the end of Q1 FY23, the Company’s cash flow and liquidity position also seemed strong, with cash and cash equivalents of $5.7 million, and operating cash flow of $19.9 million, compared to $4.1 million and $(33.1) million respectively during Q1 FY22.

Long Term Outlook

Beyond FY23, as the supply chain normalizes further, the Company expects to sell approximately 9,500 units including 1,500 unit EVs, and generate $100 million or 8% adjusted EBITDA on approximately $1.25 billion in revenues – this could be as early as FY24.

Image Source: Company

Beyond that in the medium-term, Blue Bird’s EV growth and operational improvement is expected to support volumes of 10,500 to 11,000 units including EVs in the range of 2,500 to 3,500 units generating revenues of $1.5 billion to $1.75 billion, with adjusted EBITDA of $150 million to $200 million or 10% to 11%.

The Company’s long-term target remains to drive profitable growth towards $2 billion in revenues comprising 12,000 units, of which 5000 revs and generate EBITDA of approximately $250 million or 12%.

Given current market conditions, the target provided by the Company seems achievable. There is a pent-up demand for school buses, as retail sales have been off from their average of 32,000 units per year for the past three years in a row and the national school bus fleet is aging. The market was first constrained by COVID and school closures and has been held up more recently by the supply chain.

It is forecasted that the demand for school buses will grow at a compound annual growth rate of 10% from Blue Bird’s FY23 to FY27. There is also a commitment from the highest level of government to electrify the country’s school bus fleet.

Blue Bird is expected to be a direct beneficiary of the above opportunities as they have more electric school buses on the road today than any of their competitors. The Company will also benefit from its proven reputation as a leader in alternative powered school buses for over a decade, an exclusive partnership with Ford and ROUSH that offers them a distinct performance advantage, and a collaboration with Cummins that offers a powertrain partner with over 100 years of experience and who knows the school bus industry inside and out.

Product Innovations and Recent Initiatives

Blue Bird is the clear leader in alternative powered school buses and they continue to introduce new products to support growing consumer demand for these products. In the past, they introduced several product innovations.

More recently, during FY21, Blue Bird successfully launched the all-new, Ford 7.3L V8 engine in our gasoline and propane powered offerings.

Apart from the above, the Company has also commenced a number of manufacturing and process initiatives to build customer loyalty, reduce costs, and enhance competitiveness:

In other words, the Company has a consistent track record of introducing environment and customer friendly product innovations. They have also consistently upgraded their facilities as and when needed – all these efforts are likely to pay off in the near future.

Thus, Blue Bird seems well poised to progress by leaps and bounds over the upcoming few years, fuelled by a boom in the school bus industry, and also due to its strong fundamentals and initiatives.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://www.sec.gov/ix?doc=/Archives/edgar/data/1589526/000158952623000022/blbd-20221231.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1589526/000158952622000091/blbd-20221001.htm

https://s23.q4cdn.com/152250413/files/doc_presentations/2023/02/BLBD-1Q23-Earnings-Deck-vF.pdf

https://finance.yahoo.com/news/blue-bird-corporation-nasdaq-blbd-120635654.html